What Is Zelle and How Does It Work?

Zelle is a fast, safe, and easy-to-use digital payment service that allows users to send and receive money directly between bank accounts in the United States. The platform has rapidly gained popularity as a convenient alternative to traditional methods like cash, checks, and wire transfers. This article explores the features of Zelle and explains how it operates.

How Zelle Works

Zelle’s primary objective is to simplify the process of transferring money between friends, family members, or even paying bills with select businesses. To access Zelle, users need a bank account from a participating financial institution or the standalone Zelle app. The service partners with major banks and credit unions across America, enabling seamless transactions among its users.

Steps to Use Zelle

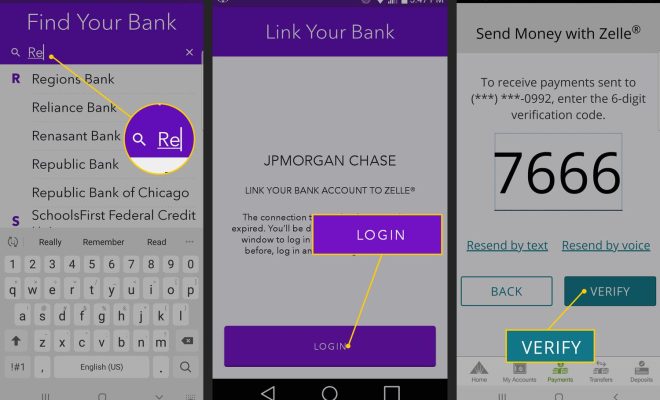

1. Check your bank’s compatibility: First and foremost, determine whether your bank offers Zelle within its mobile banking app or online banking platform. If not, you can still download the standalone Zelle app from the App Store or Google Play Store.

2. Sign up: Create an account using your email address or U.S. mobile number. If your financial institution supports Zelle, sign in through your existing online/mobile banking platform.

3. Link your bank account: Connect your eligible checking or savings account by following the on-screen instructions.

4. Send or request money: To send money, select the recipient by entering their email address or mobile phone number. Input the amount you want to transfer, review and confirm the transaction details before submitting it.

To request money, simply input the email address or phone number of the person you’re requesting funds from and specify the requested amount.

5. Receive money: When someone sends you money through Zelle, it’ll be deposited directly into your linked bank account.

Advantages of Using Zelle

– Speed: One of its key benefits is speed as transactions typically process within minutes when both the sender and recipient have accounts with participating banks.

– Security: Partnering with major financial institutions ensures secure transactions with robust encryption and authentication protocols. Additionally, Zelle does not store sensitive user information on its servers.

– No additional fees: Most participating banks offer Zelle as a free service for their customers.

– Convenience: Zelle’s direct bank-to-bank transfers eliminate the need to visit ATMs or carry cash.

Potential Limitations

– Limited international support: Currently, Zelle is only available for transactions between U.S. bank accounts.

– Lack of fraud protection: As Zelle transactions are instant, exercising caution when sending money to new or untrusted recipients is essential. Reversing transactions may be difficult if funds are sent to the wrong recipient.

In conclusion, Zelle is a user-friendly and efficient digital payment platform ideal for quick peer-to-peer money transfers within the United States. By following best practices and verifying recipients before sending payments, users can enjoy hassle-free and secure transactions with their friends, family, and even businesses that support Zelle as a payment option.