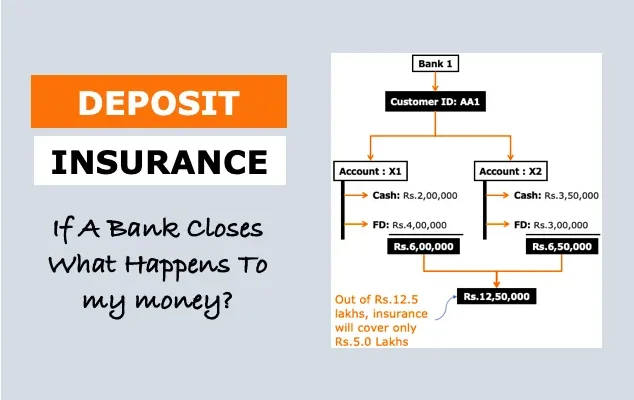

What Happens to My Money if My Bank Closes?

Introduction:

The prospect of your bank shutting down may be frightening, especially when it comes to ensuring the safety of your hard-earned money. In this article, we will address what happens to your funds if your bank closes and the mechanisms in place to protect your assets.

Federal Deposit Insurance Corporation (FDIC) Protection:

In the United States, the Federal Deposit Insurance Corporation (FDIC) is a federal agency that insures deposits in banks. In the event a bank closes, FDIC insurance protects your funds up to $250,000 per depositor, per insured bank, for each account ownership category. This means that even if your bank fails, you will not lose the money you have in insured accounts up to this limit.

National Credit Union Administration (NCUA) Protection:

For credit unions, the National Credit Union Administration (NCUA) provides an equivalent protection for members. The NCUA’s Share Insurance Fund (SIF) insures deposits at federally insured credit unions up to $250,000 per member. Like FDIC insurance, this coverage applies per account ownership category.

Bank Resolution Process:

When a bank closes, regulators work quickly to initiate a resolution process. This typically involves one of three outcomes:

1. Acquisition by another bank: A healthy bank may purchase the failing institution. In this case, customers’ accounts are transferred to the new bank seamlessly without any disruptions or inconvenience.

2. Bridge Bank: Regulators may establish a temporary “bridge bank” that assumes all assets and liabilities of the closed institution. Customers will have access to their funds during this transition period until a new buyer is found or assets are liquidated.

3. Payoff Method: If no buyer is found and a bridge bank is not established, the FDIC or NCUA will pay depositors directly up to the insured limit.

Possible Delays in Accessing Assets:

While the federal insurance coverage from the FDIC or NCUA ensures that customers are protected up to the insured limit, there might still be some temporary inconveniences as the resolution process unfolds. For example, access to online banking services and transaction processing may be disrupted for a short period.

Conclusion:

It’s crucial to understand that though bank closures can be worrisome, your money is protected by federal safeguards like the FDIC and NCUA. In most cases, your funds will remain accessible throughout the resolution process, and your new financial institution will work to ensure a seamless transition. Nonetheless, it’s always a good idea to stay informed about the health of your bank or credit union and ensure your deposits remain within the insured limits.