The 10 Biggest Banks in the US: A Comprehensive Overview

In the United States, the banking sector plays a vital role in driving economic growth and stabilizing financial markets. The biggest banks in the country facilitate both local and global transactions and set the tone for the American financial landscape. Here’s a look at the top 10 biggest banks in the US, based on their asset size, influence, and market capitalization.

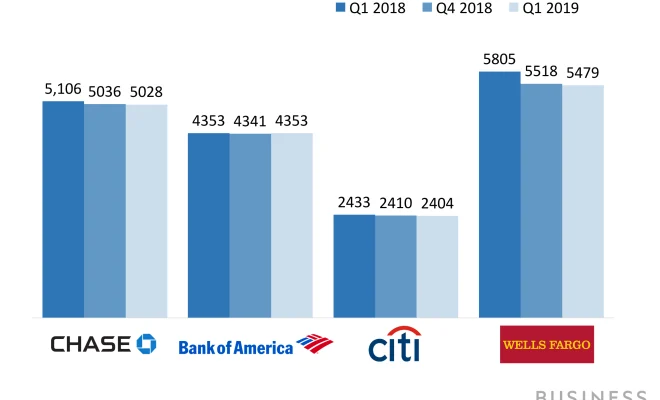

1. JPMorgan Chase & Co.

With assets worth over $3 trillion, JPMorgan Chase & Co. is currently the largest bank in the United States. Headquartered in New York City, it provides various financial services such as investment banking, consumer banking, commercial banking, and asset management.

2. Bank of America Corp.

Bank of America is another major player in the banking industry with approximately $2.5 trillion in assets. Based out of Charlotte, North Carolina, it offers retail banking services, wealth management solutions, and investment opportunities to millions of customers.

3. Wells Fargo & Co.

Established in 1852, Wells Fargo is one of the oldest banks on our list with assets close to $2 trillion. They provide various financial services such as retail banking, commercial lending, wealth management, and investment solutions across its vast operational network.

4. Citigroup Inc.

Citigroup is another New York-based bank with an asset value that surpasses $1.9 trillion. It serves clients worldwide through its comprehensive range of consumer and investment banking products and services.

5. The Goldman Sachs Group Inc.

Goldman Sachs has earned a reputation for being a top-tier investment bank focusing on assets management, underwriting securities, mergers and acquisitions advisory services and generating profits surpassing $12 billion annually.

6. Morgan Stanley

With about $1 trillion in assets under management (AUM), Morgan Stanley is well-known for providing investment banking services to large corporations and governments across the globe. Its robust trading division has contributed considerably to its overall growth.

7. The Bank of New York Mellon Corp.

The Bank of New York Mellon is the largest custodian bank globally, with over $41 trillion in assets under custody and administration. With its long history and expertise, the bank has established itself as a trusted service provider for asset management, wealth planning, and investment advisory services.

8. US Bancorp

US Bancorp is the parent company of US Bank National Association, which is headquartered in Minneapolis, Minnesota. With over $560 billion in assets, the bank offers a broad range of financial services including retail banking, mortgage banking, and payment services.

9. Truist Financial Corporation

Formed by the merger of BB&T and SunTrust Banks in 2019, Truist Financial Corporation is relatively new to this list but not new to the industry. It currently oversees around $505 billion in assets and offers a comprehensive range of retail, commercial banking and wealth management services.

10. The PNC Financial Services Group Inc.

Closing out our list is PNC Financial Services Group with approximately $463 billion in assets. Headquartered in Pittsburgh, Pennsylvania, PNC offers commercial and residential lending services as well as treasury management solutions to businesses.

In conclusion, the ten biggest banks in the US play a critical role in shaping the country’s economic landscape. While they come with their unique histories and areas of expertise, each contributes significantly to maintaining stability within American financial markets and providing essential services to millions of customers worldwide.