Pros and Cons of Credit Cards: What You Need to Know

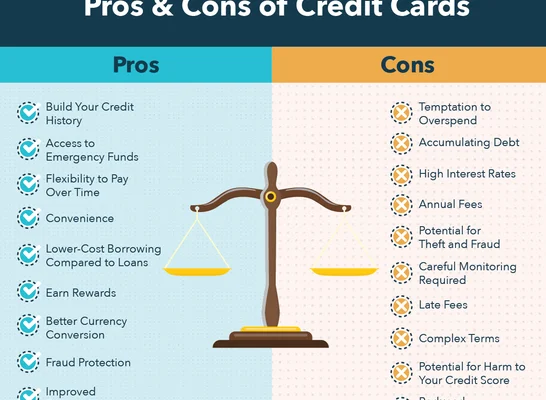

Credit cards have become an essential financial tool for many people. They offer convenience, opportunities for rewards, and a way to build a credit history. However, they also come with potential pitfalls that can lead to financial problems if not used responsibly. This article explores the pros and cons of credit cards, helping you become well-informed about your decisions regarding this versatile payment method.

Pros of Credit Cards:

1. Convenience: Credit cards allow you to make purchases without carrying cash. They are accepted at many locations worldwide and can even be used for online transactions, making shopping more accessible and effortless.

2. Rewards and Benefits: Many credit card companies offer rewards programs like cashback, air miles, or points that can be redeemed for various products and services. These incentives encourage card usage and provide additional value by reducing the overall cost of your purchases.

3. Building Credit History: By responsibly using a credit card over time, you can establish a positive credit history, which is essential when it comes to acquiring loans or applying for mortgages or rental properties.

4. Emergency Expenses: Unexpected expenses like medical emergencies or car repairs can be managed with a credit card when your cash reserves are insufficient.

5. Security Features: If your credit card is lost or stolen, you can report it promptly to limit your liability for unauthorized charges. Additionally, many cards come with extra safety features such as fraud protection, which monitors transactions for suspicious activity.

Cons of Credit Cards:

1. Debt Accumulation: Uncontrolled spending can lead to mounting debt as interest accumulates on any unpaid balance on your credit card statement each month. High-interest rates on certain cards could further complicate this issue.

2. Impact on Credit Score: Irresponsible use of a credit card – such as late payments or carrying high balances – may have a negative impact on your credit score, affecting future borrowing opportunities.

3. Overspending: Credit cards make it easy to succumb to impulse buying or spending beyond your means because they provide the illusion of unlimited funds.

4. Fees and Penalties: Late payment fees, annual fees, and balance transfer fees are some of the charges associated with credit cards that can add up quickly and erode the benefits you may have gained.

5. Potential for Fraud: Although safety measures are in place, credit card fraud remains a concern. Thieves can steal your card information and use it for unauthorized purchases.

In conclusion, credit cards can be a valuable tool when used responsibly, providing convenience, rewards, and an opportunity to build a healthy credit history. However, potential users must be aware of the potential pitfalls such as accumulating debt, overspending, and risking their credit score. Practicing good money management habits and regularly reviewing your account statements can help you enjoy the benefits of credit cards while minimizing the risks involved.