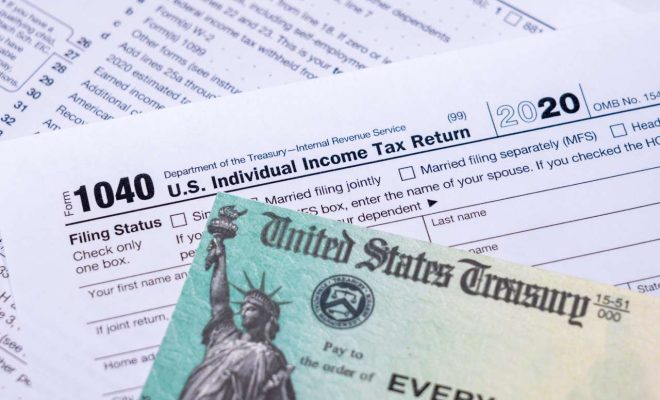

How to Track a Paper Tax Refund Check That’s Coming in the Mail

Receiving a paper tax refund check via mail can feel like an exciting reward after all the hard work you’ve put into filing your taxes. However, waiting for that check to arrive can be nerve-wracking. Here are some steps you can follow to track your paper tax refund check and put your mind at ease.

1. Check Your Refund Status Online

The easiest way to track your paper tax refund check is by using the Internal Revenue Service (IRS) “Where’s My Refund?” tool, found on their website. To use this online service, you will need your Social Security number or Individual Taxpayer Identification Number (ITIN), your filing status, and the exact refund amount. Simply enter these details to get your refund information in real-time.

2. Call the IRS

If you prefer speaking with someone directly or if you encounter issues using the online tool, consider calling the IRS helpline at 1-800-829-1954. Be prepared with your Social Security number or ITIN, filing status, and expected refund amount when calling.

3. Wait at Least 4 Weeks Before Contacting the IRS

After receiving confirmation that your tax return has been processed, it is recommended to wait at least four weeks before checking the status of your paper tax refund check. This buffer of time is necessary because it allows the IRS time to process refunds and send out checks via mail.

4. Always File Your Taxes On Time

To minimize delays in receiving your paper tax refund check, make sure you file your taxes on or before the deadline specified by the IRS. Late filings could lead to delayed processing times and a longer wait for your check to arrive in the mail.

5. Request a Refund Trace, if Necessary

In rare cases where it has been more than six weeks since mailing your return and you still have not received your paper tax refund check, you can request a refund trace. To start a refund trace, you will need to call the IRS at 1-800-829-1954 or visit your local IRS office.

In conclusion, tracking your paper tax refund check can be done easily by using the “Where’s My Refund?” tool on the IRS website, calling the IRS helpline, or waiting for an appropriate amount of time before contacting them. By staying diligent and ensuring you file your taxes on time, you’ll have a better chance of receiving your tax refund check swiftly through the mail.