Credit Card Balance Transfers Could Save You Money on Your Debt: Here’s How They Work

Dealing with credit card debt can be overwhelming and challenging, but there are strategies available to help you save money as you work toward becoming debt-free. One of the most effective methods for lowering your overall debt is through a credit card balance transfer. In this article, we’ll explore how balance transfers work, identify potential benefits, and discuss how you can take advantage of this financial strategy.

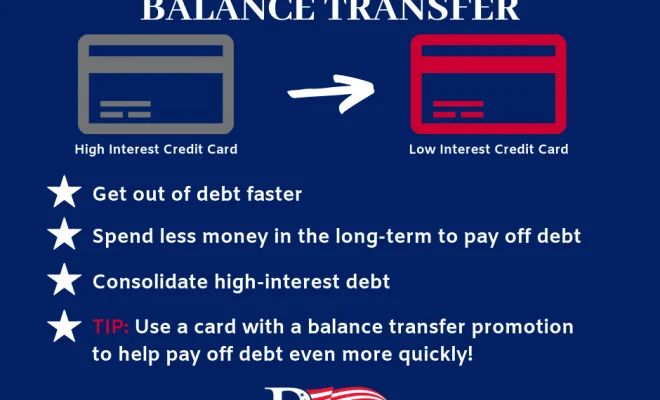

Understanding Credit Card Balance TransfersA credit card balance transfer involves moving your outstanding debt from one or more high-interest credit cards to a new credit card that offers a lower interest rate, often with an introductory 0% APR period. This allows you to save on interest charges while making it easier to manage your payments in one place.

How Balance Transfers Can Save You Money

The primary benefit of a balance transfer is that it allows you to save money on interest payments. Most credit card issuers offer special promotions on new accounts, including 0% APR interest for a set period of time—usually between 12 and 21 months. During this promotional period, you pay no interest on the transferred balance, potentially saving you hundreds or even thousands of dollars.

Moreover, if you consolidate multiple credit cards into a single account with a lower interest rate, it simplifies your monthly payments and may even help improve your credit score over time.

Taking Full Advantage of Balance Transfer Offers

To make the most of a balance transfer offer, consider the following steps:

1. Search for the Best Deal: Look into various promotions from different lenders to ensure that you find the best introductory offer for your needs.

2. Commit to Paying Off Debt: Determine how much you can realistically pay each month to maximize the benefits from the 0% APR period.

3. Read the Fine Print: Make sure to carefully review the terms and conditions associated with a balance transfer promotion, such as potential transfer fees.

4. Monitor and Adjust Your Payments: It’s crucial to manage your payments and pay on time each month. Check your account regularly to ensure that you’re making progress toward paying off your debt.

5. Avoid New Debt: While transferring your balance, resist the urge to accumulate more debt. Focus on paying off the existing balance before using the credit card for new purchases.

Conclusion

Credit card balance transfers can be an excellent strategy for saving money on interest and getting closer to a debt-free life. Before committing to a balance transfer, it’s essential to understand how they work, compare offers from different issuers, and develop a plan to pay off the transferred balance within the promotional period. By carefully managing your finances and leveraging this smart financial tactic, you can significantly reduce the overall cost of your debt.