X1 Credit Card: More Features and Rewards Than Most No-Annual-Fee Cards

Introduction

The X1 Credit Card is revolutionizing the no-annual-fee credit card market by offering its cardholders an array of exclusive features and rewards that go beyond what most competitors offer. With a sleek design, higher spending limits, and smart technology, it is a compelling choice for those seeking a powerful yet affordable credit card option. In this article, we will delve into the features and rewards that set the X1 Credit Card apart from others in its class.

Higher Spending Limits

One of the standout features of the X1 Credit Card is its provision for higher spending limits. Based on your income, X1 offers up to 5x higher credit limits compared to traditional credit cards in the same category. This elevated limit not only allows for increased purchasing power but also aims at providing users with better control over their credit utilization.

Innovative Reward System

The X1 Credit Card boasts an intricate reward system where cardholders can earn points on every purchase they make. For every dollar spent, users receive 2x points. Additionally, when users spend more than $15,000 in a year, their point accumulation rate increases to 3x per dollar spent. Moreover, if they refer others who successfully sign up for an X1 Credit Card, users can earn an impressive 4x points per dollar spent.

These points can be conveniently redeemed for merchandise, travel expenses, or cashback. Interestingly, X1 has partnered with various leading brands to offer exciting deals and additional rewards when using their platform.

No Annual Fees and Low Interest Rates

As mentioned earlier, the X1 Credit Card does not charge any annual fees – which is a significant advantage compared to other feature-rich cards in the market. Besides having no annual fees, it also offers low interest rates and comes with intelligent autopay options that cater to the user’s preferences and needs.

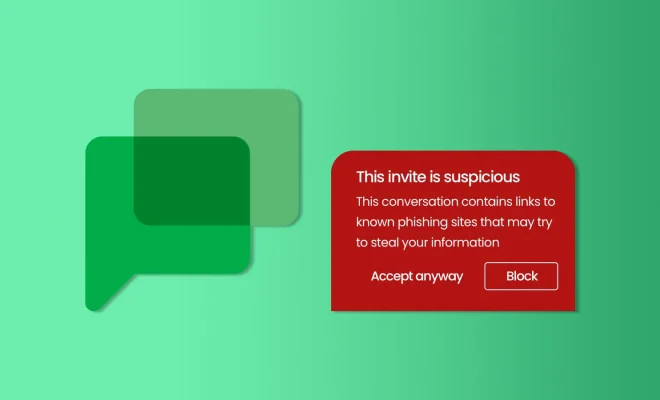

Enhanced Security Features

X1 prioritizes security by integrating cutting-edge technology to protect users from fraud and theft. The card’s smart virtual features allow users to generate new security codes easily and eliminate the need to cancel or replace the card in case of misplacement or theft. Furthermore, X1 ensures that any unauthorized transactions are flagged instantly, providing users with peace of mind.

Easy-Breezy Integration with Smartphones

The X1 Credit Card’s compatibility across major smartphone platforms allows users to track and manage their account on the go. This mobile integration streamlines bill payments, real-time expense tracking, and credit score monitoring – catering to users who prioritize convenience alongside their rewards.

Conclusion

The X1 Credit Card brings forth a fresh perspective on no-annual-fee credit cards by offering diverse features and rewards that outshine its competitors. With enticing benefits that include higher spending limits, a unique reward system, enhanced security features, and seamless smartphone integration, it is quickly becoming a popular choice among discerning, financially savvy consumers.