What’s the Difference Between Visa, Mastercard, American Express, and Discover Cards?

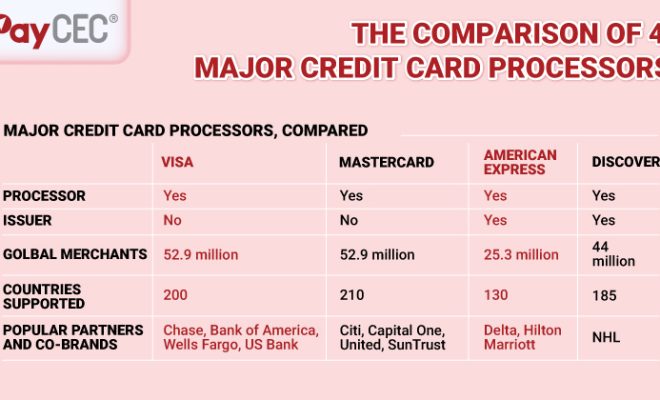

In today’s fast-paced world, credit cards have become a popular mode of payment for a wide range of goods and services. Visa, Mastercard, American Express, and Discover are among the top choices for credit cards globally, but what makes these brands distinct from each other? In this article, we will explore the differences between these four major credit card networks.

1. Visa

Visa is one of the largest and most widely accepted payment networks worldwide. It offers different types of cards, such as debit cards, credit cards, prepaid cards, and even gift cards. Visa does not directly issue the credit cards; instead, it partners with financial institutions to provide consumers with various card options. Some of the key features of Visa cards include:

– Universal acceptance in millions of locations

– Various levels of reward programs and benefits (Visa Classic, Visa Gold, Visa Platinum)

– Fraud protection and robust security features

2. Mastercard

Mastercard is another leading global payment network with a broad range of card services such as credit cards, debit cards, prepaid cards, and business cards. Like Visa, Mastercard collaborates with financial institutions to issue their branded cards. Here are some notable aspects of Mastercard:

– Widespread acceptance in over 210 countries

– Tiers available with additional perks (Mastercard Standard, Mastercard Gold, Mastercard World)

– Offers robust security measures to safeguard users from fraud

3. American Express

American Express (Amex) operates differently from Visa and Mastercard. Amex serves as both the card issuer and payment network provider. While not accepted as universally as Visa or Mastercard due to generally higher processing fees for merchants, it offers several advantages to its cardholders:

– Exclusive rewards program (Membership Rewards) that provides points for eligible purchases

– A variety of premium card options with additional benefits (Amex Green, Gold, Platinum, and

Centurion)

– Enhanced customer service and travel-related perks

4. Discover

Discover Card is a payment network known for its cash back rewards and excellent customer service. It also differs from Visa and Mastercard since it operates as both the card issuer and payment network provider. While Discover’s acceptance is growing, it may not be as widely accepted internationally as Visa or Mastercard. Key highlights of

Discover cards include:

– Competitive cashback reward offers on purchases

– No annual fee on many core cards

– Various card options with distinct features (Discover it Cash Back, Discover it Miles, Discover it Chrome)

In conclusion, the differences between Visa, Mastercard, American Express, and Discover cards revolve around acceptance levels, the issuer/payment network relationship, rewards programs, and card options. Each of these credit card networks offers unique benefits and features to cater to different user needs. It’s essential to assess your financial goals when selecting the best card for you. Whether you want better rewards, lower fees, or broader acceptance in a credit card network, each of these card networks has a personalized option available for you to choose from.