What Is a Virtual Credit Card and How Do You Use It?

Introduction:

A virtual credit card is an innovative financial product that aims to provide users with enhanced security and convenience during online transactions. It has quickly gained traction among consumers looking for additional layers of protection. In this article, we will explore what a virtual credit card is, its benefits, how to obtain one, and how to use it for secure online payments.

What is a Virtual Credit Card?

A virtual credit card is a digital version of a traditional plastic credit card. It functions just like a regular credit card by providing users with a unique credit card number, expiry date, and security code (CVV). However, the primary difference is that the virtual card does not exist in physical form – it only exists in your online account or digital wallet.

Benefits of Virtual Credit Cards:

1. Enhanced Security: Virtual credit cards offer an extra layer of protection by utilizing single-use or time-sensitive numbers. This feature ensures that even if hackers intercept your card details during an online transaction, they cannot use them for unauthorized purchases.

2. Customizable Spending Limits: You can set spending limits on your virtual cards to better manage your expenses and minimize the risk of overspending.

3. Easy Replacement: If your virtual card details are compromised, you can quickly create a new one without waiting for a physical replacement.

4. Better Privacy: Since no physical card is involved, virtual credit cards help maintain privacy by mitigating the risk of losing or misplacing your sensitive financial information.

How to Obtain a Virtual Credit Card:

To obtain a virtual credit card, you need to follow these simple steps:

1. Choose an Issuer: Several banks and financial institutions offer virtual credit card services, including Mastercard, Visa, American Express, and Discover. Research their offerings to find the one that best suits your needs.

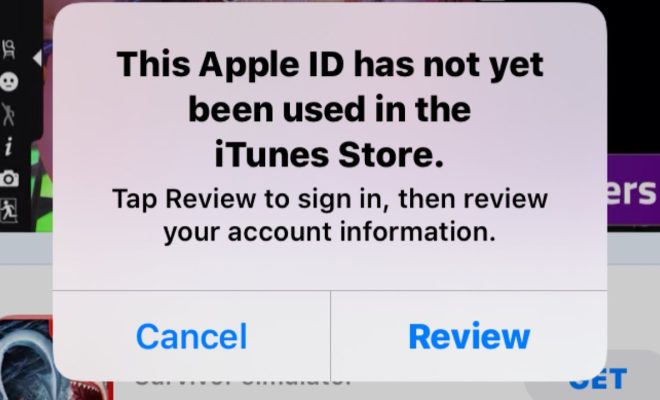

2. Sign Up: Register on your chosen issuer’s website or mobile app and provide the necessary identification information.

3. Access Your Virtual Card: Once your account is approved, you will receive your virtual credit card details, including the number, expiration date, and CVV.

How to Use Your Virtual Credit Card for Online Transactions:

Using a virtual credit card is straightforward; just follow these steps:

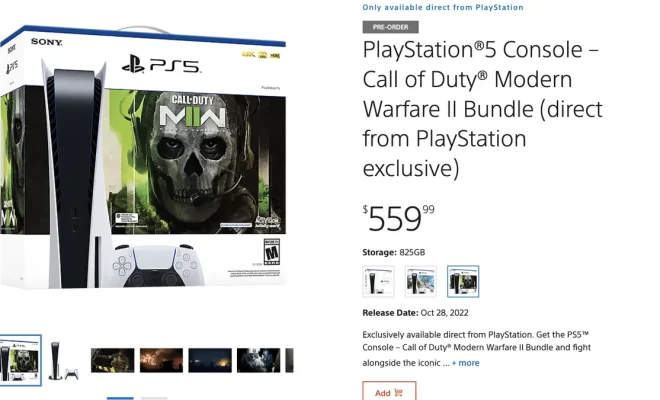

1. Shop Online: Browse your desired online store and add items to your cart as usual.

2. Proceed to Checkout: As you check out, choose the credit card payment option.

3. Enter Your Virtual Card Details: Input your virtual credit card number, expiration date, and CVV in the required fields.

4. Complete the Transaction: Review the order summary and click on “submit” or “confirm” to finalize the transaction.

Conclusion:

Virtual credit cards offer a secure and efficient way to conduct online transactions while minimizing the risk of fraud and unauthorized purchases. By obtaining one of these innovative financial tools, you can have peace of mind when shopping online, knowing that your sensitive information is protected.