What Is a CD Ladder and How Do You Build One?

Introduction:

A Certificate of Deposit (CD) ladder is an investment strategy that involves dividing the total amount you wish to invest into multiple CDs with different maturity dates. This approach allows you to benefit from the higher interest rates typically offered by longer-term CDs while still having access to portions of your investment at regular intervals. In this article, we’ll discuss the benefits of a CD ladder, how it works, and a step-by-step guide on how to build one.

Benefits of a CD Ladder:

1. Liquidity: With a CD ladder, you have a portion of your investment maturing at regular intervals, which means you can access your funds without incurring early withdrawal penalties.

2. Interest Rate Protection: When building a CD ladder, your investment is spread across various interest rate environments. This helps mitigate the risk of investing all your money at once during an unfavorable interest rate period.

3. Reinvestment Opportunities: As each CD matures, you can reinvest the funds into another longer-term CD or use them as needed.

How Does a CD Ladder Work?

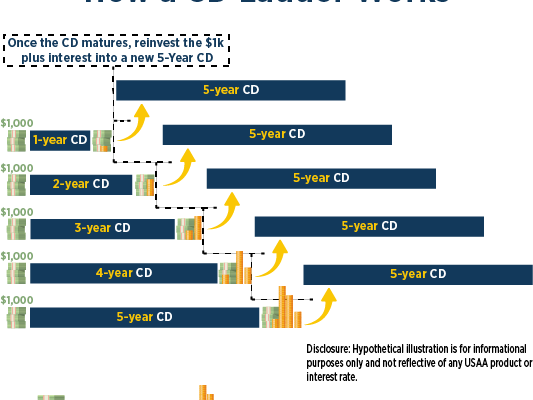

A CD ladder consists of multiple CDs with staggered maturity dates. For example, if you divide your investment into five equal parts, you might purchase CDs with 1-year, 2-year, 3-year, 4-year, and 5-year maturities. When the 1-year CD matures, you reinvest those funds in a new 5-year CD. As each subsequent CD matures, you continue this process

– always investing in new 5-year CDs. Over time, this allows you to take advantage of potentially higher interest rates without tying up all of your money for extended periods.

How to Build a CD Ladder:

1. Determine the amount you want to invest: Begin by deciding how much money you want to allocate towards your CD ladder.

2. Choose the number of rungs: Decide how many “rungs” you want in your ladder, which will determine the number of CDs and their respective maturity dates.

3. Divide your investment: Divide your total investment by the number of rungs to determine how much to allocate to each CD.

4. Open your CDs: Starting with the shortest-term CD, open a CD account for each rung of the ladder and invest the determined amount from step three.

5. Reinvest matured CDs: When a CD matures, reinvest those funds into a new, longer-term CD at the top of your ladder.

Conclusion:

A CD ladder is an effective way to boost your savings while mitigating some of the risks associated with locking up all your funds in long-term investments. By strategically investing in multiple CDs with staggered maturity dates, you can enjoy liquidity, interest rate protection, and increased reinvestment opportunities. Follow these steps to build your own CD ladder and maximize the potential of this low-risk investment strategy.