Private Mortgage Insurance: How PMI Works

Introduction

Purchasing a home is a significant milestone that often requires meticulous planning and a great deal of financial responsibility. For many prospective homeowners, private mortgage insurance (PMI) is an essential component of their mortgage journey. It enables them to own their dream home while protecting the lender’s interests. In this article, we’ll delve into the concept of private mortgage insurance, how it works, and crucial factors you need to know.

What is Private Mortgage Insurance (PMI)?

Private mortgage insurance is a type of insurance policy designed to protect lenders from potential losses if a borrower defaults on a home loan. Typically, lenders require borrowers who cannot make a down payment of at least 20% to purchase PMI. This mandate helps reduce the lender’s exposure to high-risk loans, as PMI can recuperate any losses in case the borrower fails to make timely payments.

How Does PMI Work?

1. Payment Process: PMI can be paid in several ways: as a one-time premium at closing (also known as single premium), monthly premiums added to the mortgage payment, or a combination of both (split premium). The payment method may depend on the borrower’s preferences and the lender’s available options.

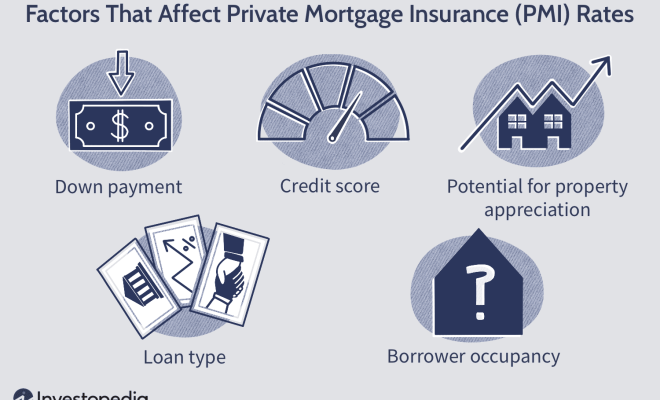

2. Calculation: The cost of PMI varies depending on factors like loan size, credit score, and down payment amount. Typically, it ranges from 0.3% to 1.5% of the original loan amount per year. A higher down payment or better credit score may result in lower PMI rates.

3. Cancellation: Homeowners are not required to pay PMI for the entire duration of their mortgage term. Once the homeowner pays down the principal balance to reach 20% equity or when the property value increases enough to push equity above 20%, they can request cancellation of their PMI payments. Additionally, by law in the US, PMI is automatically terminated once the homeowner reaches 22% equity in their property, provided all required payments are up-to-date.

Benefits and Drawbacks of PMI

Benefits:

– Accessible homeownership: PMI enables borrowers with limited financial capabilities to acquire homes sooner as it requires small down payments.

– Financial planning: Paying monthly PMI premiums allows borrowers to spread the cost of their down payment over a more extended period, enabling better cash flow management.

Drawbacks:

– Increased mortgage expense: PMI premiums increase the overall cost of a home loan. Borrowers should weigh their monthly mortgage expenses carefully, considering their household finances.

– No borrower protection: It’s essential to remember that PMI protects lenders, not borrowers. Borrowers are still responsible for repaying the entire loan balance in case of default.

Conclusion

Private mortgage insurance is a vital element of the home loan process for borrowers who can’t produce substantial down payments. While it increases homeownership accessibility, prospective buyers should fully understand the cost implications and cancellation terms before purchasing a PMI policy. With proper research and financial planning, homeowners can strike a balance that works best for them and meets lenders’ requirements.