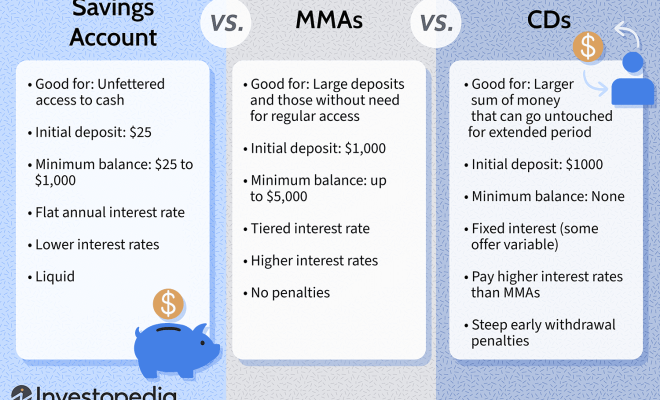

Money Market Accounts, Savings Accounts, and CDs: Which One Is the Best?

When it comes to managing your personal finances, choosing the right type of account to hold your money is crucial. Money Market Accounts (MMAs), Savings Accounts, and Certificates of Deposit (CDs) are three popular options for those looking to save and invest their money. The best option depends on an individual’s financial goals, risk tolerance, and access needs. In this article, we will explore the key features of each type of account and help you determine which one may be best suited for your financial needs.

1. Money Market Accounts (MMAs)

A Money Market Account is a type of savings account offered by banks and credit unions. They typically have higher interest rates than traditional savings accounts and allow limited check-writing capabilities. Some MMAs also come with a debit card for additional convenience.

Pros:

– Higher interest rates compared to traditional savings accounts

– Limited check-writing capabilities

– May come with a debit card

Cons:

– Minimum deposit requirements may be higher

– Transaction limits per month

– Interest rates can fluctuate

2. Savings Accounts

Savings accounts are the most basic type of deposit account offered by banks and credit unions. They typically have lower interest rates compared to MMAs but require lower minimum

deposits. Savings accounts are ideal for those looking to start building an emergency fund or saving for short-term goals.

Pros:

– Lower minimum deposit requirements

– Easy access to funds

– Generally low fees

Cons:

– Lower interest rates compared to MMAs and CDs

– Limited transactions per month

– No check-writing capabilities

3. Certificates of Deposit (CDs)

A Certificate of Deposit is a time-bound deposit offered by banks and credit unions. It involves committing a specific amount of money for a predetermined period, which can range from a few months to several years. CDs usually offer higher interest rates compared to savings accounts and MMAs but come with penalties for early withdrawals.

Pros:

– Higher interest rates compared to MMAs and savings accounts

– Various terms available, catering to different investment horizons

– FDIC insured

Cons:

– Limited access to funds until the CD matures

– Penalties for early withdrawal

– Interest rates are fixed, so you could miss out on higher returns if rates increase

Conclusion:

There is no one-size-fits-all answer to the question of which account type is the best. The right choice depends on your financial goals, risk tolerance, and liquidity needs. If easy access to your funds is a priority and you don’t want to worry about minimum deposit requirements, a traditional savings account might be the best choice. If you’re willing to commit your money for a longer-term and lock in higher interest rates, a CD might be more suitable.

Finally, an MMA can offer a middle-ground solution, providing higher interest rates than a savings account while still allowing limited access to your funds. Consider these factors carefully before choosing the best account type for your financial situation.