How an Online IRS Account Can Help You Get Your Taxes Finished

The era of sifting through mountains of paperwork and tax forms is over, thanks to the advancement of technology and the internet. One significant technological innovation that has transformed the landscape of tax filing is the online Internal Revenue Service (IRS) account. It offers numerous benefits that make getting your taxes done efficiently a reality. In this article, we will explore how an online IRS account can help you complete your taxes much faster and with more ease.

1. Easy access to relevant tax records:

With an online IRS account, you have instant access to important tax records such as your previous years’ returns, payment history, and adjusted gross income (AGI). Having all this information in one place makes it much easier to fill out and check your current year’s tax filings.

2. File your taxes electronically:

One significant advantage of having an online IRS account is the ability to file your taxes electronically through eFile. By using eFile, you can submit your returns directly to the IRS, saving you time and ensuring your filings are received securely. This method also allows for quicker processing times, potentially speeding up any refund you may be owed.

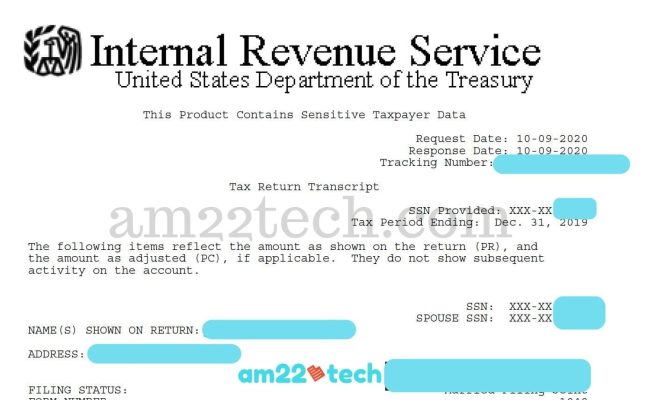

3. Convenient access to tax transcripts:

If you ever need a copy of your past tax return information—for example, when applying for a loan—your online IRS account provides access to tax transcripts. These documents display a summary of your return information, including wages, income, and taxes paid. By accessing these electronically, you no longer have to wait for a mailed copy or visit an IRS office in person.

4. Update personal information:

Life changes can significantly impact your taxes. If you have a change in name or address during the year, it’s essential to update that information with the IRS promptly. Having an online account makes it easy to update your personal details quickly and avoid complications when it comes time for filing.

5. Set up payment arrangements:

If you find yourself in a situation where you are unable to pay your taxes in full, the online IRS account allows you to apply for a payment plan. This system enables you to propose a monthly payment amount and request an installment agreement directly through your account.

6. Stay informed about your tax status:

An essential aspect of staying on top of your taxes is knowing the status of your current and past filings. With an online IRS account, you can track the status of tax returns, refunds, and payments. This type of access provides valuable insight into your financial health and ensures you don’t miss any deadlines or outstanding payments.

In conclusion, an online IRS account is a powerful tool that simplifies and streamlines the tax filing process. By providing easy access to crucial documents, offering electronic filing options, tracking refunds and payments, and accommodating personal information updates, an online IRS account can help you get your taxes finished quickly and accurately. So whether you’re new to tax filing or a veteran taxpayer looking for ways to simplify this annual duty, creating an online IRS account is a step worth taking as it significantly improves efficiency.