Home Equity Line of Credit (HELOC) Rates for 2023: A Comprehensive Overview

In recent years, home equity lines of credit (HELOC) have emerged as a popular financing option for many homeowners. This is mainly due to their flexibility and attractive interest rates. In this article, we will delve into the world of HELOC rates for 2023 and offer some essential insights into what you can expect from this financial tool.

What is a Home Equity Line of Credit (HELOC)?

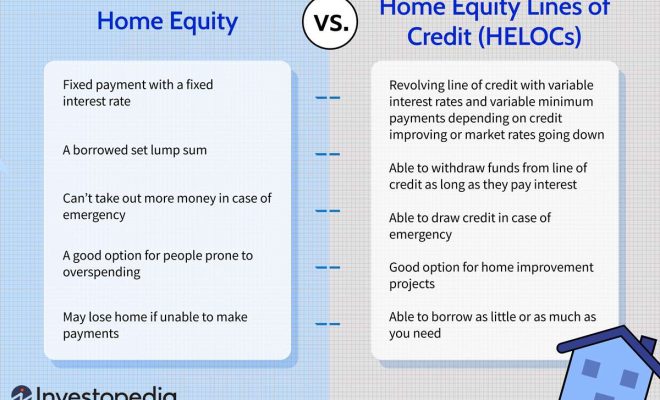

A HELOC is a type of loan that allows homeowners to borrow against the equity they have built up in their homes. This means that instead of receiving a lump sum, borrowers can access funds as needed over an extended period, typically through a credit card or checkbook tied to the account.

HELOC Rates in 2023

As we look ahead to 2023, it’s important to consider how the current market conditions might impact HELOC rates. With the Federal Reserve implementing policies to steady inflation and promote economic growth, it’s reasonable to expect that HELOC rates will remain competitive and potentially trend downwards in certain cases.

Generally, HELOC interest rates consist of two components: the index and the margin. The index is usually based on the prime rate published in sources such as The Wall Street Journal. The margin, on the other hand, is determined by the lender based on factors such as credit history and loan-to-value ratio (LTV).

Fixed vs. Variable Interest Rates

When it comes to choosing a HELOC rate, there are primarily two options available: fixed-rate and variable-rate loans. Fixed-rate HELOCs secure an interest rate for the entire term of the loan, offering stability and predictability but often at a higher rate initially than variable-rate options.

Variable-rate HELOCs tie interest rates to a market-based benchmark like the prime rate. While these rates may start lower than fixed-rate options, they can also fluctuate over time as market conditions change. It’s essential to weigh the pros and cons of each before deciding which option best suits your financial needs.

Factors Affecting HELOC Rates

Several factors can influence the interest rates offered on a HELOC. These include:

1. Credit Score: Borrowers with higher credit scores are more likely to receive lower interest rates.

2. Loan-to-Value Ratio (LTV): The ratio comparing the amount of the loan to the appraised value of the home can impact rates. Higher LTV ratios may result in higher interest rates.

3. Debt-to-Income Ratio (DTI): Lenders sometimes consider borrowers with lower DTI ratios, indicating a healthy balance between debt and income, to be less risky and offer them lower interest rates.

Conclusion

In 2023, it’s likely that HELOC interest rates will remain competitive, providing homeowners with an attractive financing option for their needs. Navigating these waters involves understanding current market conditions and factors that may impact individual rate offers; yet, with proper research and preparation, a HELOC can prove to be a valuable financial tool for many homeowners.