Don’t Miss These Tax Credits if You Want the Biggest Possible Tax Refund

Introduction:

Tax season is upon us, and it’s essential to take advantage of tax credits to ensure you receive the biggest possible tax refund. Tax credits can significantly lower your tax liabilities, and even provide a refund in some cases. In this article, we will discuss some of the top tax credits you don’t want to miss for maximizing your tax returns.

1. Earned Income Tax Credit (EITC):

The EITC is designed for low-to-moderate income working individuals and families. The amount of earned income tax credit you can receive depends on your income and the number of qualifying children. The maximum EITC for 2021 is $6,728. Be sure to double-check your eligibility and claim this credit if possible.

2. Child Tax Credit (CTC):

The Child Tax Credit has been expanded under the American Rescue Plan Act of 2021. Families with children under 17 are eligible for a tax credit of up to $3,000 per child ($3,600 for children under six). The credit is also now fully refundable, meaning families can receive the full amount of the credit regardless of their earned income.

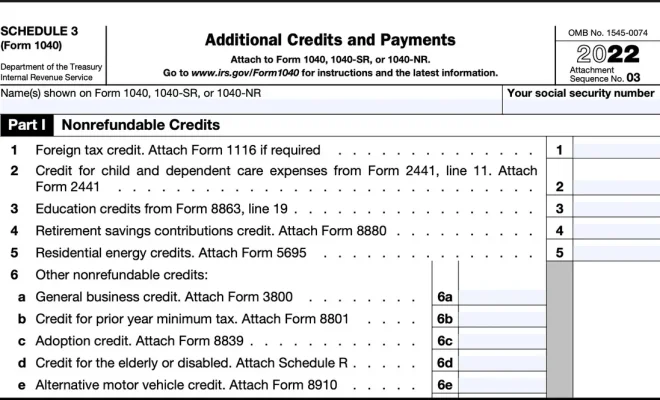

3. Child and Dependent Care Credit:

If you pay for childcare or care for a dependent with disabilities, this credit can help lower your tax bill. For 2021, eligible expenses have increased up to $8,000 for one qualifying person and up to $16,000 for two or more qualifying persons. You can claim a percentage of these expenses as credit based on your adjusted gross income (AGI).

4. American Opportunity Tax Credit (AOTC):

The AOTC helps offset college education costs for eligible students in their first four years of higher education. This credit allows a maximum annual claim of $2,500 per student, with up to $1,000 being refundable. To qualify, students must be enrolled at least half-time in a degree or credential program.

5. Lifetime Learning Credit (LLC):

The Lifetime Learning Credit helps cover tuition and fees for higher education. Unlike the AOTC, the LLC applies to graduate courses, career development courses, and other forms of continuing education. This credit allows you to claim 20% of your eligible expenses up to a maximum credit of $2,000 per tax return.

6. Saver’s Credit:

If you contribute to a qualified retirement plan or an IRA, you may be eligible for the Saver’s Credit. This tax credit is designed to encourage retirement savings for low-to-moderate income earners. The maximum credit is $1,000 for individuals and $2,000 for married couples filing jointly.

Conclusion:

Taking advantage of these tax credits can significantly lower your tax liabilities and help maximize your refund. Always consult with a tax professional and ensure that you keep proper documentation of your eligibility for any credits you plan to claim. Be sure not to miss out on these valuable tax-saving opportunities when filing your taxes this year!