All 21 Types of 1099 Tax Forms, Explained

In the United States, the 1099 tax form series is widely employed for the reporting of various non-wage income types. These are essential for both taxpayers and the Internal Revenue Service (IRS). To paint a clearer picture, we have explained all 21 types of 1099 tax forms below:

1. Form 1099-A: This form is used when a borrower abandons their property or experiences involuntary property conversion due to foreclosure.

2. Form 1099-B: Brokerages use this form to report proceeds from sales of various securities, such as stocks and bonds.

3. Form 1099-C: Lenders issue this form for each calendar year to report canceled debts greater than $600.

4. Form 1099-CAP: This deals with corporate actions where cash, stock, or other property is exchanged due to an acquisition or a change in control.

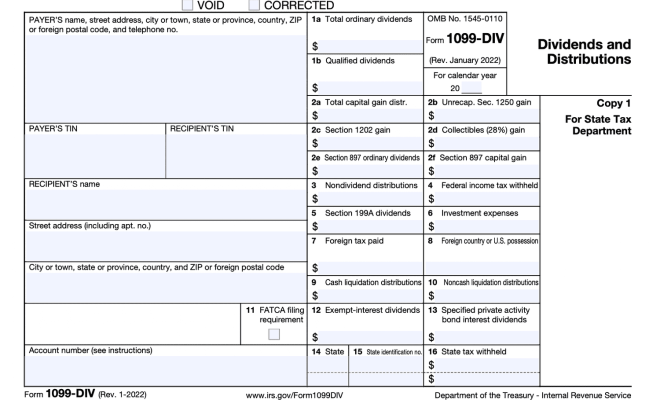

5. Form 1099-DIV: Shareholders receive this form to report dividends, capital gains distributions, and other income from investments.

6. Form 1099-G: Federal, state, or local governments use this form to report unemployment compensation, certain government payments, and income tax refunds.

7. Form 1099-INT: Financial institutions issue this form for interest income earned from investments or bank accounts.

8. Form 1099-K: Payment providers use this form to report card and third-party network transactions of goods and services.

9. Form 1099-LS: This is used by life insurance companies to report the acquisition of a life insurance contract.

10. Form 1099-LTC: Insurance companies use this form to report payments made under long-term care insurance contracts and accelerated death benefits.

11. Form 1099-MISC: This popular form is used by businesses to report miscellaneous income paid to non-employees, such as freelancers.

12. Form 1099-OID: Financial institutions issue this form for original issue discount income from certain types of bonds and other debt instruments.

13. Form 1099-PATR: This is provided by cooperatives to their patrons, detailing the allocations of taxable income and other distributions.

14. Form 1099-Q: Educational institutions use this form to report distributions from qualified tuition programs and Coverdell Education Savings Accounts (ESAs).

15. Form 1099-QA: This form reports distributions from an Achieving a Better Life Experience (ABLE) account.

16. Form 1099-R: Pension plan providers and financial institutions use this form to report retirement account distributions, including IRAs and pensions.

17. Form 1099-S: Real estate agents or individuals involved in real estate transactions use this form to report the sale or exchange of real property.

18. Form 1099-SA: This form is used for reporting disbursements or withdrawals from a Health Savings Account (HSA), Archer Medical Savings Account (MSA), or Medicare Advantage MSA.

19. Form 1099-SB: Life insurance companies issue this form to sellers of life settlements when there’s a transfer of their life insurance contract.

20. Form 1042-S: U.S. income sources use this to report income earned by foreign persons subject to withholding, such as foreign investments in the United States.

21. Form SSA-1099: Social Security recipients receive this form detailing Social Security benefits paid during the year.

Understanding these forms will help ensure accurate reporting of non-wage income, deductions, credits, and more to meet IRS requirements and stay compliant with tax laws.