How to Find Last Year’s Adjusted Gross Income to File Your Taxes

When filing your taxes, your Adjusted Gross Income (AGI) from the previous year serves as an essential reference point for various processes. It helps you determine your eligibility for certain deductions and credits. Additionally, AGI is critical for validating your electronic filing process with the Internal Revenue Service (IRS). If you’re unsure about how to find your last year’s AGI, this article offers guidance on locating that information.

1. Check Your Previous Tax Return

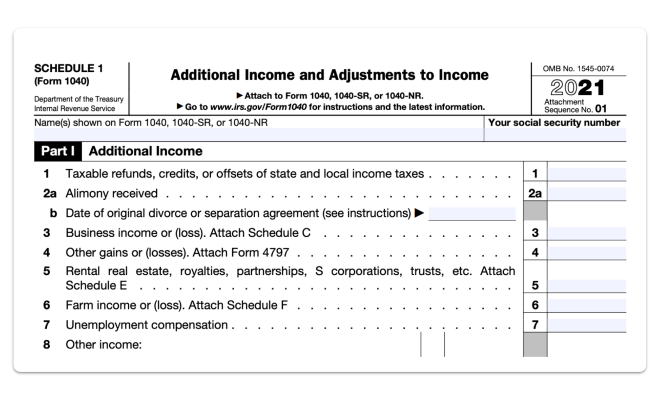

The easiest and most straightforward way to find your last year’s AGI is by referring to your previous tax return. Your AGI should be clearly stated on line 8b of Form 1040 or line 35 on the old Form 1040 of the prior year.

2. Request a Tax Account Transcript from IRS

If you misplaced your final tax return or don’t have access to it, you can obtain a free tax account transcript from the IRS that includes your AGI details. To request a transcript:

– Visit the IRS’ Get Transcript website (https://www.irs.gov/individuals/get-transcript)

– Create an account or login with your personal information.

– Select “Tax Account Transcript” and choose the appropriate tax year.

– You can view the transcript online or receive it by mail.

3. Contact Your Tax Preparer

If you sought help from a tax professional during the previous filing season, they should have records of your taxes filed, including your AGI. Reach out to them and request a copy of your return containing that information.

4. Use Tax Software Programs

If you used a tax software program like TurboTax, H&R Block, or TaxAct for your previous year’s filing, log in to the application and access your prior year’s tax return. Most software programs store previous returns for a certain number of years digitally.

5. If you didn’t file taxes last year

In case you didn’t file your taxes last year, enter ‘0’ as your AGI when prompted. This tells the IRS that you don’t have an AGI for the previous year.

In conclusion, finding your last year’s Adjusted Gross Income becomes vital while filing your taxes. This information helps in various aspects of navigating the tax process efficiently and correctly. Keep track of your previous returns and use the methods mentioned above to locate your AGI when needed.